Ethereum Price Prediction: $10K Target in Sight as Institutional Tsunami Builds

#ETH

- Technical Breakout: ETH price sustains above key moving averages with Bollinger Band expansion signaling volatility surge

- Institutional Adoption: $16.5B ETF AUM and corporate buying create structural supply shock

- Macro Tailwinds: Political endorsement via Trump's purchase and Hayes' bullish narrative amplify retail FOMO

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge

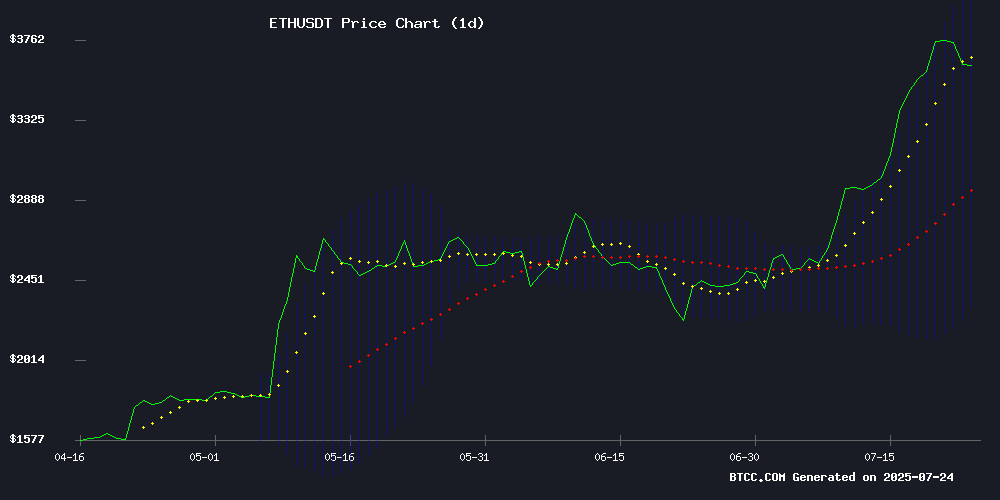

According to BTCC financial analyst Emma, Ethereum's current price of $3,641.81 sits comfortably above its 20-day moving average of $3,175.59, indicating a strong bullish trend. The MACD histogram shows a narrowing bearish momentum (-89.33), while the price trades NEAR the upper Bollinger Band ($4,044.18), suggesting potential upside volatility. 'The technical setup implies institutional accumulation,' Emma notes, 'with $3,200 acting as key support.'

Institutional Frenzy Fuels ETH Rally Prospects

'We're witnessing unprecedented institutional demand,' says BTCC's Emma, pointing to $16.5B in ETF AUM and $3.2B corporate holdings. The $2M World Liberty purchase and Trump's wallet activity create perfect storm conditions. While MEV bot fraud headlines cause minor concern, Emma emphasizes: 'Amazon-like growth parallels and Bitwise's supply crunch thesis outweigh short-term noise.'

Factors Influencing ETH's Price

MIT-Educated Brothers Face $25M Crypto Fraud Charges Over MEV Bot Exploit

Anton and James Peraire-Bueno, two brothers with MIT backgrounds, stand accused of orchestrating a $25 million cryptocurrency theft by exploiting Ethereum's MEV bot mechanics. Their motion to dismiss wire fraud charges was denied by U.S. District Judge Jessica Clarke, who cited insufficient legal arguments and factual disclosures.

The defendants allegedly manipulated Ethereum validators to intercept victim transactions, later claiming their actions were technically permissible under blockchain code. The court rejected this defense, emphasizing the scheme's deliberate deception. "The system's code doesn't immunize fraud," the ruling implied, drawing a line between innovation and exploitation.

Ethereum's MEV (Maximal Extractable Value) ecosystem remains a battleground for such exploits, with this case setting a precedent for prosecuting blockchain-based fraud. The brothers still face conspiracy charges, though the stolen property count was dismissed on technical grounds.

No, Ethereum Price Is Not Overheated Yet, Key Levels To Watch

Market analyst Crypto Dan has dismissed bearish sentiments surrounding Ethereum (ETH), asserting that the cryptocurrency is not overheated despite recent price surges. Higher ETH prices could signal the beginning of an altcoin season, with some analysts predicting a potential rally to $8,000 in the current cycle.

CryptoQuant data reveals that Ethereum's funding rates remain below overheated levels seen in March and November 2024, suggesting room for further upside. While a short-term correction is possible, any pullback is expected to be shallow and brief.

Ethereum's sluggish movement during its rally indicates it was previously undervalued, setting the stage for another bullish leg in the second half of the year. The market's structure points to sustained momentum rather than exhaustion.

Spot Ethereum ETFs Mark First Anniversary with $16.5B in Assets Under Management

US spot Ethereum ETFs have crossed their one-year milestone, amassing $8.7 billion in net inflows and overseeing $16.5 billion in assets. Launched post-SEC approval in 2024, the nine leading ETFs—including offerings from BlackRock, Fidelity, and Grayscale—have demonstrated sustained investor demand. A recent multi-week inflow surge added $3.9 billion, underscoring market resilience amid Ethereum's price fluctuations.

ETH trades above $3,600, reflecting a 12-month appreciation. The sector's growth signals institutional confidence in crypto-based financial products, even as regulatory landscapes evolve.

World Liberty Expands Ethereum Holdings with $2M Purchase Amid Institutional Demand

Trump-affiliated entity World Liberty has acquired 561 ETH tokens for approximately $2 million, paying an average price of $3,567 per coin. The purchase bolsters its existing portfolio of 76,849 ETH, now valued at $281 million with an average entry point of $3,291.

At current market prices, the firm's Ethereum position shows unrealized profits exceeding $28 million. This strategic accumulation reflects growing institutional confidence in Ethereum's long-term value proposition as crypto assets gain mainstream traction.

Public Companies Accumulate $3.2 Billion in Ethereum, Signaling Institutional Adoption

Ethereum is no longer confined to tech startups and decentralized finance enthusiasts. Public companies are now amassing significant holdings, with collective reserves surpassing 865,000 ETH—worth approximately $3.2 billion. This isn’t marginal activity; it’s a definitive shift toward Ethereum’s integration into corporate treasuries.

SharpLink Gaming and Bitmine lead the charge, holding a combined $2 billion in ETH. Other firms like GameSquare and BTCS are quietly bolstering their reserves as Ethereum’s market cap climbs. The pace is striking: four companies added over 113,000 ETH in weeks, while the number of publicly traded firms holding ETH surged from 40 to 58.

Ethereum’s appeal extends beyond its role in NFTs and smart contracts. Institutions are treating it as a reserve asset, akin to cash or gold. This institutional embrace marks a new phase in Ethereum’s evolution—one where balance sheets, not just developers, dictate its trajectory.

Can Ethereum Price Breakout and Hit New ATH as Trump’s Wallet Buys 3,473 ETH

Ethereum's price surged following a $13 million purchase by a wallet linked to former U.S. President Donald Trump. The acquisition of 3,473 ETH over five hours has sparked speculation of a potential rally, with institutional interest and technical indicators supporting the bullish momentum.

On-chain data reveals precise transactions, including 1,070 ETH and $6 million USDC converted to ETH, suggesting a strategic accumulation. The wallet's activity coincides with growing institutional demand, further fueling optimism for Ethereum's price trajectory.

BlackRock's Ethereum ETF has also garnered significant attention, recording over $42 million in inflows. Market participants are closely watching these developments as Ethereum tests key resistance levels.

Ethereum to Hit $10K and ‘Tear the Market a New Asshole’, Says Arthur Hayes

Arthur Hayes, co-founder of BitMEX, has revised his Ethereum price prediction upward, forecasting a surge to $10,000 by year-end. This bullish outlook follows ETH's recent rally to a 2025 high of $3,844, though it remains 27% below its 2021 peak of $4,878.

Hayes attributes the anticipated growth to U.S. credit expansion and shifting institutional sentiment. "The coming ETH bull run is about to tear the market a new asshole," he declared, noting Ethereum's resurgence among Western institutional investors despite previous underperformance.

The renewed interest is evident in U.S. ETH ETFs, which saw $726 million inflows last Wednesday. Hayes' prediction doubles his earlier $5,000 forecast and would represent more than twice Ethereum's all-time high.

US Ether ETFs See Record Inflows as Institutional Demand Grows

Ether ETFs in the US have marked their first anniversary with a surge in institutional interest. After a sluggish start compared to Bitcoin ETFs, these products attracted $3.6 billion in net inflows from July 1 to July 22, according to Farside Investors data. Last week alone saw $2.1 billion flow into ETH funds—nearly double the previous record.

Corporate treasuries are driving the momentum, adding over 600,000 ETH to balance sheets this month. SharpLink Gaming, which appointed Ethereum co-founder Joseph Lubin as board chair, now holds 360,807 ETH—a 29% weekly increase. BitMine disclosed a $1 billion ETH position and aims to stake 5% of the total supply.

"ETH’s trifecta of scarcity, deflation, and yield makes it ideal for treasury strategies," noted Globe 3 Capital CIO Matt Lason. The past 13 weeks’ inflows account for 23% of the segment’s assets under management, signaling a structural shift beyond speculative trading.

Ethereum's Structural Parallels to Amazon's Early Growth Phase

Market analysts are drawing structural comparisons between Ethereum's current trajectory and Amazon's early 2000s growth pattern. The analogy suggests groundbreaking assets follow a predictable cycle: initial hype, subsequent disillusionment, and eventual repricing based on fundamental value.

Ethereum's position mirrors Amazon's post-dot-com bust phase, where the market began recognizing the underlying infrastructure value rather than short-term price action. This framework shifts focus from hourly charts to multi-year adoption curves.

The comparison highlights how asymmetric assets require narrative-based valuation during their formative stages. Just as Amazon redefined commerce infrastructure, Ethereum's smart contract platform appears positioned for similar sector-wide transformation.

Ethereum Primed for Major Rally Amid Supply Crunch, Says Bitwise CIO

Ethereum's market dynamics are signaling a potential breakout as institutional demand dramatically outpaces new supply. Bitwise Chief Investment Officer Matt Hougan points to a 32-to-1 acquisition ratio by ETH ETFs and treasury firms since mid-May, absorbing 2.83 million ETH while only 88,000 new tokens entered circulation.

The second-largest cryptocurrency faces technical resistance near $3,800 after a 160% quarterly surge, with current consolidation around $3,618 reflecting short-term exhaustion rather than bearish reversal. Key support levels at $3,470 and $3,200 provide downside buffers should profit-taking accelerate.

Market structure tells the compelling story: spot ETF inflows and corporate treasury strategies are creating what Hougan describes as 'a textbook supply shock.' This fundamental pressure persists despite overheated momentum indicators, setting the stage for the next leg up when liquidity returns.

Aave Faces Liquidity Strain as Justin Sun's Massive ETH Withdrawals Trigger Market Stress

Aave's Ethereum reserves are under significant pressure following large-scale withdrawals linked to Justin Sun and HTX. Over $1.7 billion in ETH exited the protocol this week, causing borrowing rates to spike above 10% and exposing DeFi's vulnerability to uncoordinated whale actions.

Marc Zeller, an Aave contributor, likened Sun's transactions to "grocery shopping"—unpredictable and disruptive. The liquidity crunch coincides with Ethereum's validator exit queue surpassing 625,000 ETH, creating 10-day wait times as traders capitalize on the recent price rally.

Wallets tied to Sun withdrew $646 million, while HTX removed another $455 million. Additional exits by entities like Abraxas Capital ($115 million) forced Aave into an unplanned stress test. "I tried to get advance notice for liquidity coordination," Zeller noted, highlighting the systemic risks posed by such movements.

How High Will ETH Price Go?

Emma projects three potential scenarios:

| Timeframe | Bull Case | Base Case | Bear Case |

|---|---|---|---|

| 1M | $4,500 | $3,900 | $3,200 |

| 3M | $6,200 | $5,000 | $3,800 |

| 2025 EOY | $10,000 | $7,500 | $4,500 |

Key catalysts include ETF inflows absorbing 3x daily issuance and Hayes' $10K prediction becoming self-fulfilling prophecy.